Are multifamily sales cooling off?

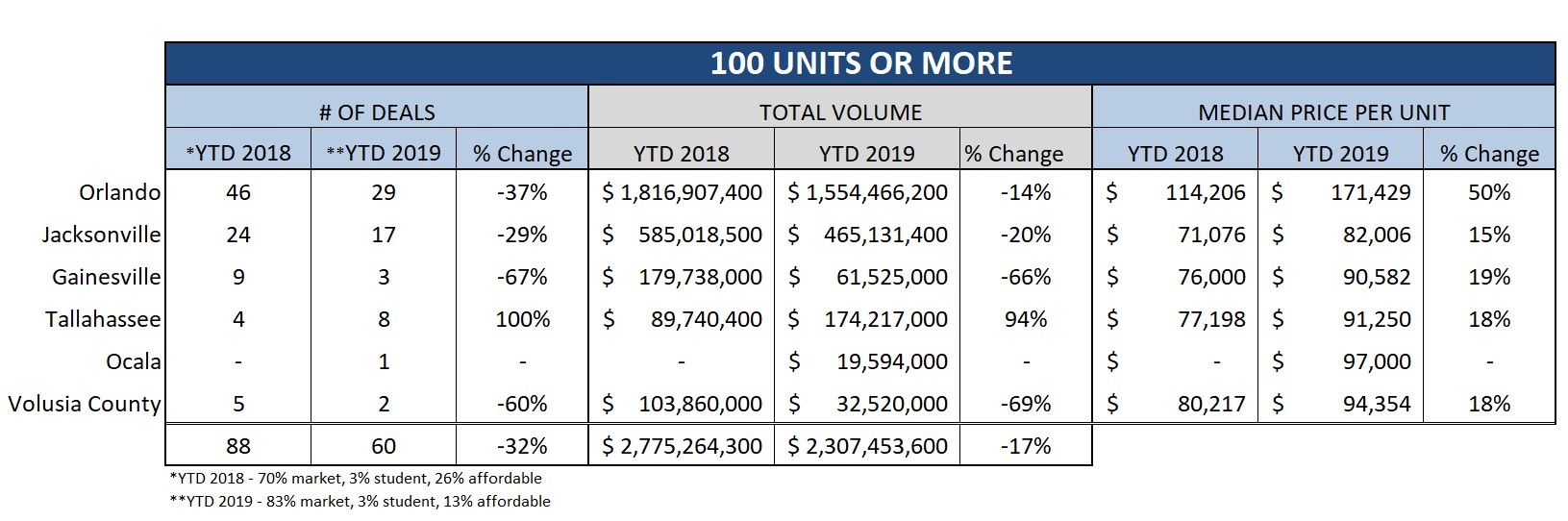

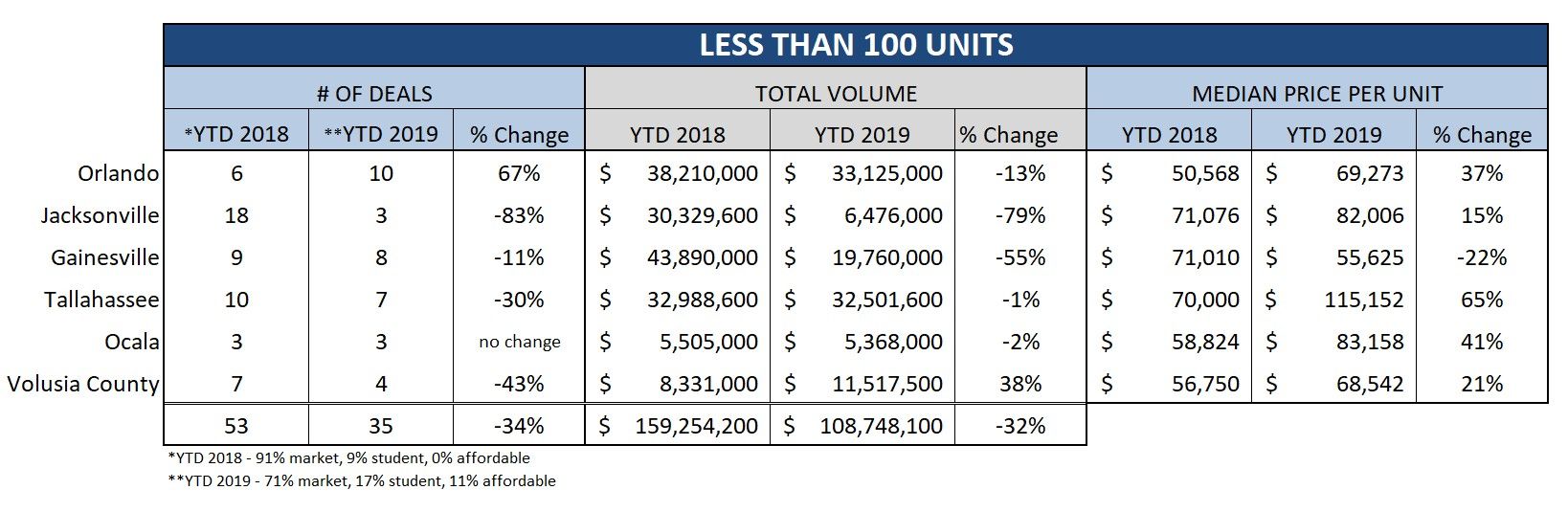

I wanted to do this quick study below because it felt like I was seeing less deals on the market within the six Florida markets I cover. I wanted more evidence. Below are two charts, over 100 units and under 100 units, comparing the number of deals closed YTD July 2019 to YTD July 2018. For both charts I combined market rate, student, and affordable housing deals in one basket however market rate is between 70-90% of all deals depending on the year and size.

For the over 100 unit transactions, the results are very obvious the market has cooled off a bit in terms of number of deals done. The price per unit however, has certainly not cooled off. Cumulatively across the six markets 2019 is down 30% in the number of deals from 2018. Looking at Orlando and Jacksonville, markets with enough data points to focus on, Orlando is down over 37% and Jacksonville over 29%. Tallahassee doubled their number of over 100 unit deals, however the number of transactions isn’t significant enough to put a lot of weight on that. Ocala is a tertiary market, typically trading more in the under 100 unit arena so it isn’t surprising to see only 1 deal in 2019. From a median price per unit perspective most of the markets increased between 15-20% over 2018 but Orlando was up a whopping 50% on their over 100 unit deals!

For the under 100 unit transactions, other than Orlando the results are also very obvious the market has cooled off in terms of number of deals done. The price per unit was still up across the board, except in Gainesville. In looking at Gainesville a little closer within the data (not pictured here), 4 of the 6 sales happened to be lower end C to C- deals that are atypical for the market and brought the price per unit median down a bit. All other markets were up a minimum of 15% in pricing per unit. Cumulatively across the six markets 2019 is down 38% in the number of deals from 2018. Jacksonville was down the most number of deals with an 83% drop.

What does this mean? Nothing alarming I don’t think. My explanation is that since January 2015 there have been 947 total sales of any apartment complex over 10 units across all 6 markets combined. There are roughly 3,200 total properties. This means that nearly 30% of all the properties have sold in the last 4.5 years. Some of those properties sold several times. That’s just under 7% of the inventory per year. Yes, there are still over 2,100 properties that haven’t sold in the last 4.5 years, we have to expect a vast majority of those deals are long term holds, or tied up in estate issues, or still within their loan term with defeasance, or some other host of other reasons why they haven’t traded yet. My point is, selling nearly 1,000 properties in under 5 years in just 6 markets in central and north Florida is a lot and we can’t all expect the pace to continue. Price per unit continues to increase, our economy is healthy, and interest rates are still ridiculously low. My bold prediction is to see pricing per unit ease up a bit by 2021.

We show investors how to operate at an elite level by helping them build a reputation in the marketplace, before, during, and especially after the transaction, which results in substantially more opportunities than their competition.