required cap rate spread

CLICK TO DOWNLOAD spreadsheet for your own use.

I wanted to know, based on lending terms at any specific time, what the spread needs to be between cap rates and interest rates in order to achieve certain cash on cash returns. In other words, if you want to earn a 7.00% cash on cash return, based on the best lending terms you can get, what does the cap rate need to be to achieve this? Most investors have tons of deals coming across their desks all the time and this is an easy guide to help sift through deals more quickly. Obviously there are other details to consider in whether to pursue a deal or not and I’m not advocating for just looking at a cap rate, but it is a worthy tool to add to your arsenal.

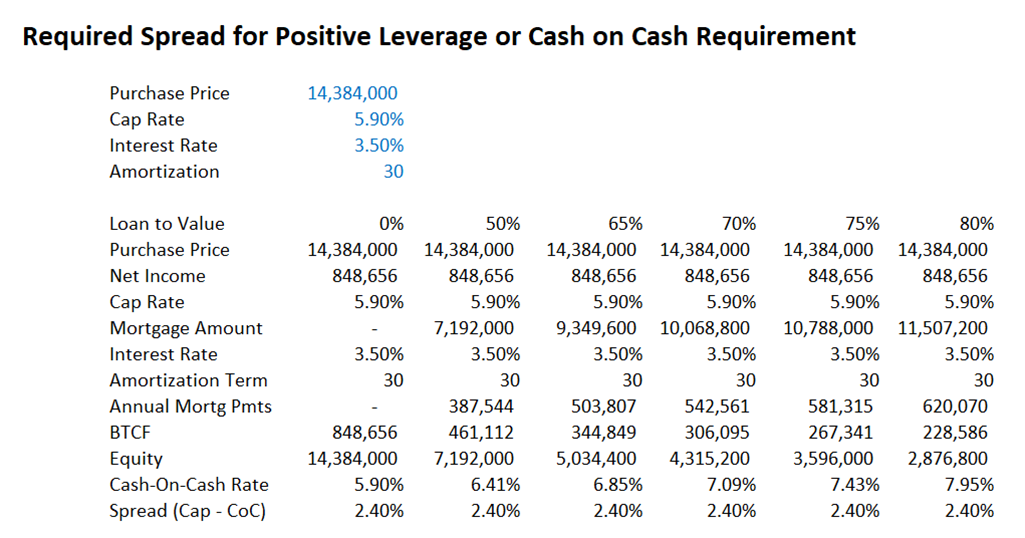

Below is an example of how the spreadsheet works. The price really doesn’t matter but you have to put one in order for the spreadsheet to work. Remember, the goal here is to determine what your spread needs to be to earn your desired cash on cash return. In this example, I’m manipulating the cap rate, interest rate, and amortization period in order to achieve at least a 7.00% cash on cash return based on a 70% LTV. Why 70% LTV, it’s arbitrary. It’s whatever equity you want combined with your ability to find a lender to fund the rest. In this example, I’m assuming a 70% LTV. As you can see, if I can borrow at 3.50% on a 30-year amo, with a 70% LTV, my spread needs to be at last 2.40%, or a 5.90% cap rate, in order to hit my target of at least 7.0% cash on cash return. If you wanted to hit at least an 8.0% cash on cash return then the spread needs to be 2.68% or a 6.18% cap rate.